Understanding Forex Trading: A Comprehensive Guide

Forex trading has gained immense popularity in recent years, transforming the financial landscape for both novice and seasoned investors. For those looking to delve into this realm, it’s crucial to understand the fundamentals of Forex and locate reliable resources, such as forex trading site kuwait-tradingplatform.com, that can guide your trading journey.

What is Forex Trading?

Forex, short for foreign exchange, refers to the global marketplace where currencies are bought and sold. Unlike stock markets, which operate within hours, Forex trading is available 24 hours a day, five days a week, allowing traders from all over the world to participate. The primary goal in Forex trading is to exchange one currency for another in order to profit from the fluctuations in their values.

The Basics of Currency Pairs

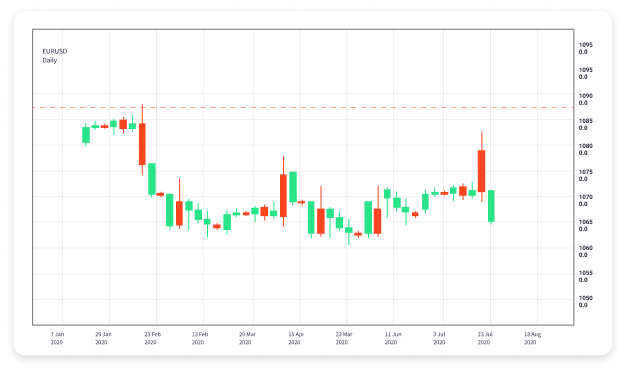

Forex trading involves pairs of currencies, known as currency pairs. Each pair consists of a base currency and a quote currency. For instance, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. If you believe the euro will strengthen against the dollar, you would buy the EUR/USD pair. Conversely, if you predict that the euro will weaken, you would sell the pair.

Types of Currency Pairs

- Major Pairs: These pairs include the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: Minor pairs do not involve the USD, such as EUR/GBP or AUD/NZD.

- Exotic Pairs: Exotic pairs involve a major currency and a currency from a developing economy, like USD/SGD or EUR/TRY.

Why Trade Forex?

Forex trading offers a plethora of advantages. Firstly, the 24-hour market means you can trade at times that fit your schedule. Additionally, with leverage options available, traders can control larger positions with less capital. Furthermore, Forex trading often has lower transaction costs compared to other asset classes, making it attractive for both short-term and long-term strategies.

Choosing a Forex Trading Platform

Finding the right Forex trading platform is crucial for your trading success. Here are some factors to consider:

- Regulation: Ensure that the trading platform is regulated by reputable financial authorities to safeguard your investments.

- User Interface: A user-friendly interface can enhance your trading experience, especially for beginners.

- Trading Tools and Resources: Look for platforms that offer comprehensive analysis tools, educational materials, and customer support.

- Fees and Spreads: Always compare the fees and spreads charged by different platforms, as these can significantly affect your profitability.

Developing a Trading Strategy

Creating a robust trading strategy is essential for success in Forex trading. Here are a few popular strategies to consider:

- Scalping: This involves making multiple trades throughout the day, aiming for small price movements.

- Day Trading: Day traders open and close their positions within the same trading day, avoiding overnight exposure to market risks.

- Swing Trading: Swing traders hold positions for several days or weeks, focusing on short-term market moves.

- Position Trading: This long-term strategy involves holding trades for extended periods, based on fundamental analysis.

Risk Management in Forex Trading

Effective risk management is vital for long-term success in Forex trading. Here are some strategies to mitigate risks:

- Use Stop-Loss Orders: Stop-loss orders automatically close a position when it reaches a certain loss level, reducing potential damage.

- Limit Your Leverage: While leverage can amplify profits, it can also amplify losses. Be cautious about how much leverage you use.

- Diversify Your Portfolio: Don’t put all your funds in one currency pair. Diversification helps spread risk across different investments.

Keeping an Eye on Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and interest rate changes, can significantly affect currency values. Understanding these indicators and how they influence the Forex market can help traders make informed decisions. Stay updated with news releases and economic calendars to anticipate market movements.

The Emotional Aspect of Trading

Forex trading isn’t just about numbers and strategies; it also requires strong psychological resilience. Traders must manage emotions like fear and greed, which can lead to impulsive decisions. Maintaining a disciplined approach, sticking to your strategy, and managing your expectations can greatly enhance your trading performance.

Learning from Your Trades

Every trade, whether profitable or not, offers lessons that can improve your trading. Keep a trading journal documenting your trades, strategies, emotions, and outcomes. Over time, this journal can become an invaluable resource for refining your approach and avoiding past mistakes.

Conclusion

Forex trading can be a rewarding yet challenging venture. By understanding the fundamentals, choosing a suitable trading platform, developing effective strategies, and managing risks, traders can enhance their prospects for success. Always approach the market with caution and continuous learning in mind. With the right mindset and tools, anyone can navigate the dynamic world of Forex trading.