Understanding Forex Trading: A Comprehensive Guide

Forex trading, or foreign exchange trading, has become increasingly popular among both seasoned investors and beginners looking to expand their financial horizons. It involves the buying and selling of currencies in the global marketplace, with the aim of making a profit from the fluctuations in currency values. Whether you’re considering trading as a hobby or a potential source of income, understanding the basics of Forex trading is essential. In this article, we will delve into the intricacies of Forex trading and how you can navigate this dynamic market, forex trading explained FX Trading UZ, while equipping yourself with the necessary knowledge to succeed.

What is Forex Trading?

Forex trading entails the exchange of one currency for another at agreed prices. This market operates 24 hours a day, five days a week, making it one of the most accessible and liquid financial markets in the world. Unlike stock markets, which operate during specific hours, Forex trading enables traders to engage in the market at any time, catering to various schedules and time zones. The primary goal of Forex trading is to profit from changes in currency values, which can be influenced by economic indicators, geopolitical events, and overall market sentiment.

Key Terminology in Forex Trading

Before diving deeper, let’s familiarize ourselves with some essential terms associated with Forex trading:

- Currency Pair: A currency pair consists of two currencies, the base currency (the first currency in the pair) and the quote currency (the second currency). For example, in the pair EUR/USD, the Euro is the base currency and the US Dollar is the quote currency.

- Pip: A pip is the smallest price move that a currency pair can make based on market convention. Most currency pairs are quoted to four decimal places, with a pip typically being the fourth decimal point.

- Spread: The spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a currency pair.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also increase losses.

- Margin: Margin is the amount of capital a trader needs to initiate a trade and maintain it. It is often expressed as a percentage of the total position size.

How Does Forex Trading Work?

Forex trading involves a network of banks, financial institutions, corporations, and individual traders who participate in buying and selling currencies. When you place a Forex trade, you are simultaneously buying one currency while selling another. The difference in exchange rates is what generates profit or loss. To engage in Forex trading effectively, here’s a basic outline of the trading process:

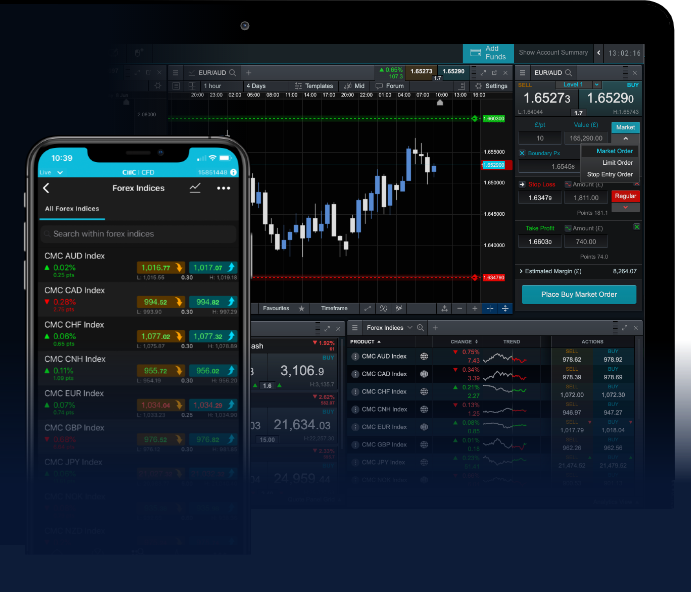

- Choose a Reliable Forex Broker: To start trading, you must select a trustworthy broker who offers a trading platform for executing trades, providing market data, and facilitating transactions.

- Open a Trading Account: After choosing a broker, the next step is to open a trading account, which can be a demo account for practice or a live account for real trading.

- Fund Your Account: Deposit funds into your trading account. Most brokers offer various payment methods, including credit cards, bank transfers, and e-wallets.

- Select Currency Pairs: Choose the currency pairs you would like to trade based on market analysis and personal intuition.

- Place Your Trade: Execute your trade by specifying the amount you wish to buy or sell, along with any stops or limits you wish to place.

- Monitor Your Trades: Keep an eye on your open positions and market conditions to make necessary adjustments or close trades when needed.

Developing a Trading Strategy

A successful Forex trading approach often involves developing a robust trading strategy that aligns with your individual risk tolerance and financial goals. Here are various strategies traders often employ:

- Scalping: This strategy focuses on making small profits from frequent trades throughout the day. Scalpers typically hold positions for very short durations, ranging from seconds to a few minutes.

- Day Trading: Day traders buy and sell within the same day, closing all positions before the market ends to avoid overnight risks. This strategy requires active monitoring of the market during trading hours.

- Swing Trading: Swing traders aim to capture price changes over several days or weeks. This longer-term strategy involves analyzing market trends and making fewer trades than day traders.

- Position Trading: Position trading is a long-term strategy where traders hold their positions for weeks or months, relying on fundamental analysis and broader market trends.

Risks Involved in Forex Trading

While Forex trading can offer lucrative opportunities, it also comes with significant risks that traders need to consider:

- Market Risk: Unpredictable market movements can lead to losses, particularly in highly volatile environments.

- Leverage Risk: While leverage can magnify profits, it can also result in large losses beyond the initial investment.

- Emotional Risk: Trading decisions are often influenced by emotions, which can lead to rash actions or missed opportunities. Maintaining discipline is crucial.

- Counterparty Risk: This risk arises from the possibility that the other party in the trade may default on their obligations, notably affecting the trade’s overall result.

Key Takeaways

Forex trading presents vast opportunities for profit, but it requires a solid understanding of market mechanics, strategies, and risk management. Whether you are new to trading or a seasoned trader, continuing to develop your skills and knowledge is essential. Start small, practice on demo accounts, and consider seeking advice from experienced traders or educators before delving into live trading. Remember, the Forex market does not guarantee profits, but with the right approach and mindset, it can be a rewarding venture.

In conclusion, by grounding yourself in the essential principles and strategies of Forex trading, you can improve your chances of success and achieve your financial goals while navigating this exciting marketplace.